rhode island property tax rates 2020

That represents one of the larger increases for any municipality in Rhode Island. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500.

Orange County Ca Property Tax Calculator Smartasset

10 States With No Property Tax In 2020 Property Tax Property Investment Property Peyton Place Places.

. 39 rows 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes. New Shoreham Residential median value. 135 of home value.

Below are the RI citytown real estate tax year schedules for use in calculating closing prorations. If so youll want to understand Rhode Islands property tax system so that you know what to expect on your first property tax bill. 1 Rates support fiscal year 2020 for East Providence.

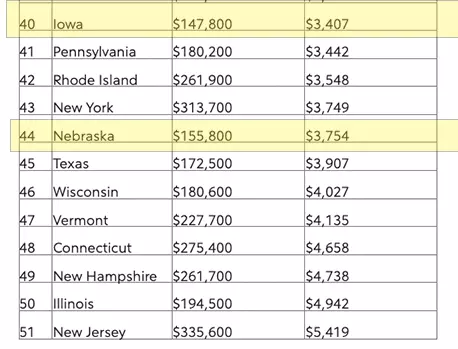

Re-ranked by 2020 median residential property value. Tax amount varies by county. Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. This process established the property values that will be utilized. Note that if you miss a quarterly payment due date.

FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial. Tax assessments are set annually as of December 31st. Counties in Rhode Island collect an average of.

It cannot be disregarded without staging a new complete assessment review. The current tax rates for. Rhode island property tax rates 2020 Tuesday June 28 2022 Edit.

Directed by State-licensed appraisers these reviews are nearly indisputable. Questions related to taxes and taxes due should be directed to the Finance OfficeTax Collections. 2989 - two to five family residences.

The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country. Searching Up-To-Date Property Records By County Just Got Easier. Tax amount varies by county.

Ad Find County Online Property Taxes Info From 2021. Rhode Island Property Tax Schedules. FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. 3243 - commercial I and II industrial commind. Rhode Island has some of the highest property taxes in.

The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective. The Town of Barrington has completed a State-mandated Revaluation of all Real Property with an effective date of 12312020. 3470 - apartments with six or more units.

41 rows West Warwick taxes real property at four distinct rates. The states sales tax rate is 7 and there are no local sales taxes to raise that. 3 West Greenwich - Vacant land taxed at.

2 Municipality had a revaluation or statistical update effective 123119. 39 rows Providence has the highest property tax rate in Rhode Island with a property tax rate. Tax Assessors Office 675 Ten Rod Road Exeter RI 02822.

Lets say four local similar. RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0. After closing at 1601 for 2020 that rate climbed to 1642 the following year.

The current tax rates and exemptions for real estate motor vehicle and tangible property. As Percentage Of Income. Rhode Island Property Tax Rates.

2022 Property Taxes By State Report Propertyshark

Rhode Island Property Tax Calculator Smartasset

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Rhode Island Property Tax Calculator Smartasset

10 States With No Property Tax In 2020 Property Tax Property Investment Property

Property Taxes By State Embrace Higher Property Taxes

Property Taxes Explained Omaha Relocation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax Comparison By State For Cross State Businesses

Center For State Tax Policy Tax Foundation

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com

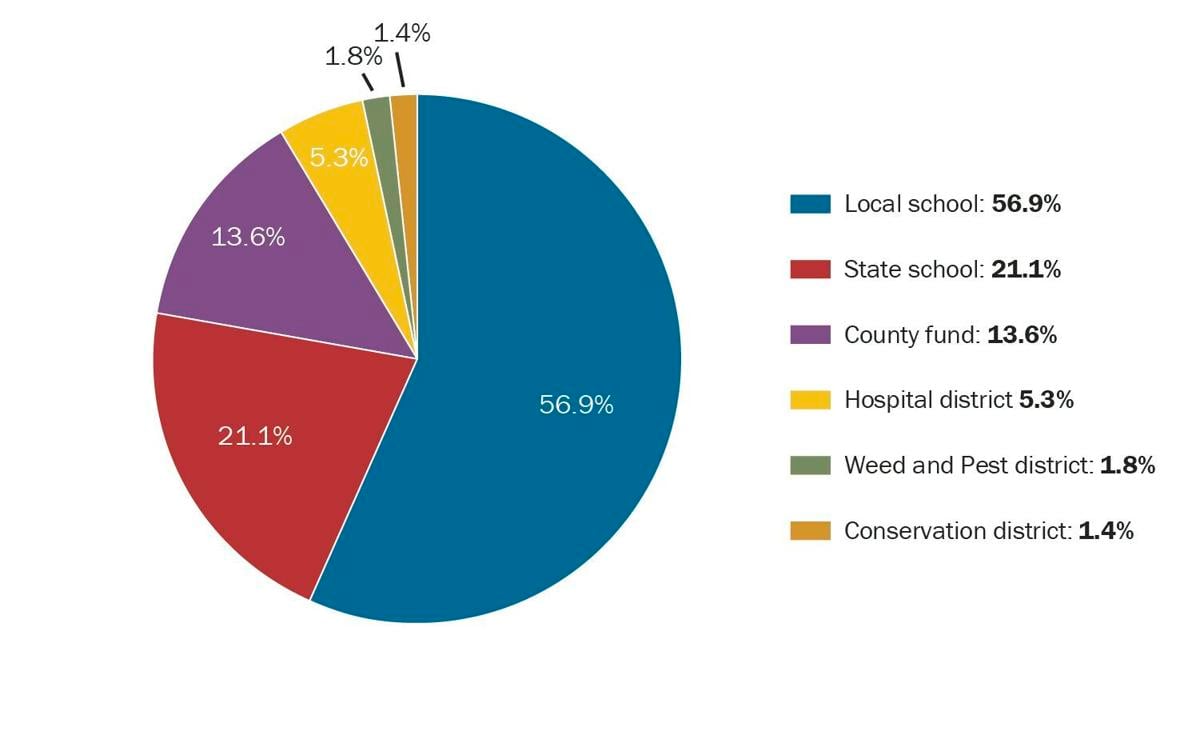

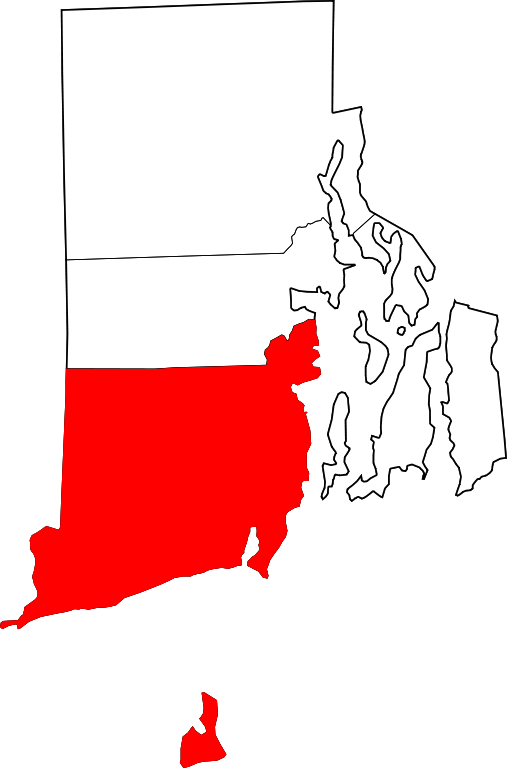

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return

Just Listed 28 Carrie Anne Drive Cranston Ri 02921 Debut In Hillside Farm This Is A Perfect Family Hom Family Room Hillside Farming Home And Family

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)