louisiana estate tax rate

It partially taxes income from private pensions and withdrawals from retirement accounts like 401k plans. However because of the varying tax.

Louisiana Property Tax Calculator Smartasset

For periods beginning on or after January 1 2022 fiduciaries are taxed on net income computed at the following rates.

. Regenerated Max Mill Reports from 2005-2009 for all parishes except Orleans and Regenerated Max Mill Reports from 2006-2010 for Orleans Parish reflect the data in the current 2010 millage. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. But just because Louisiana does.

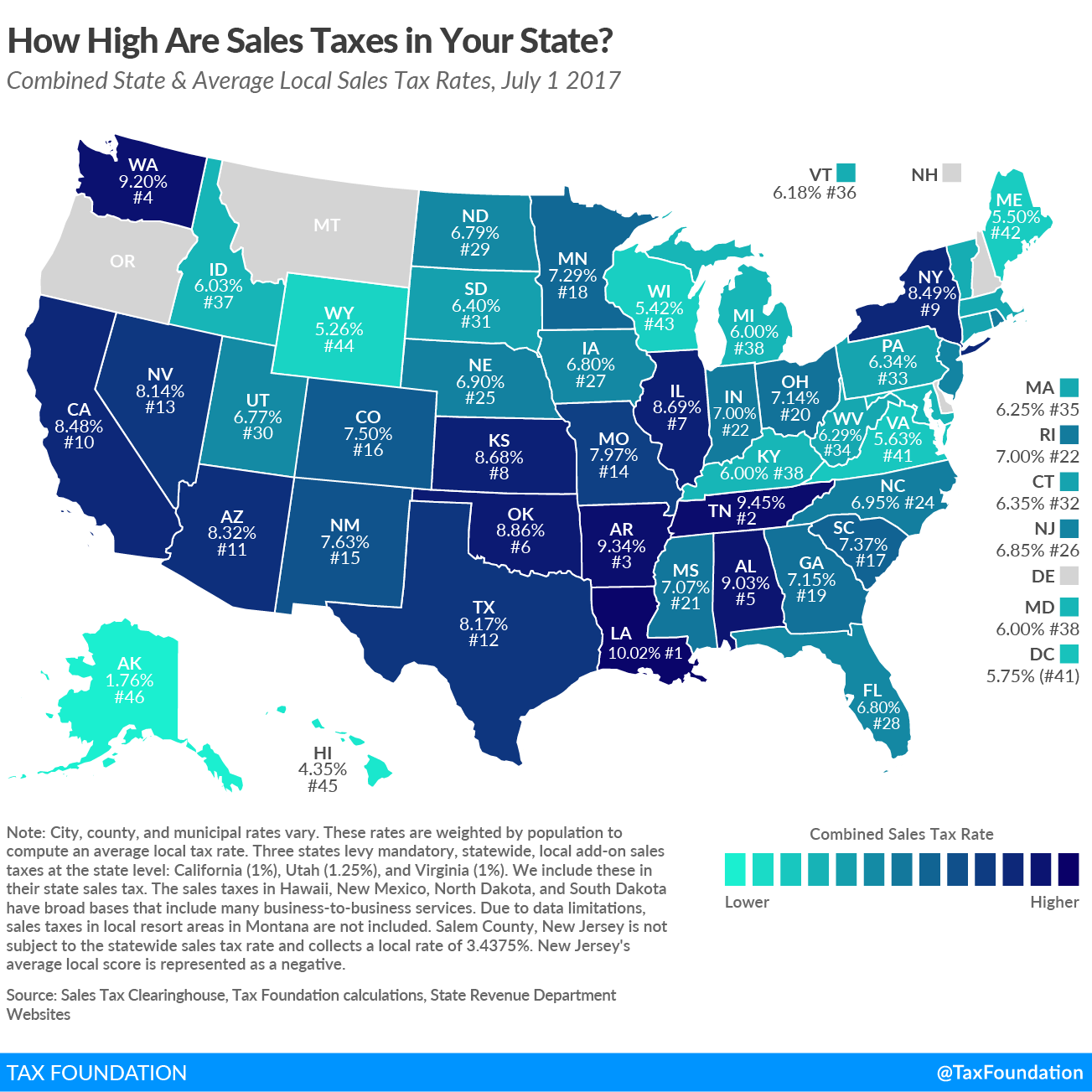

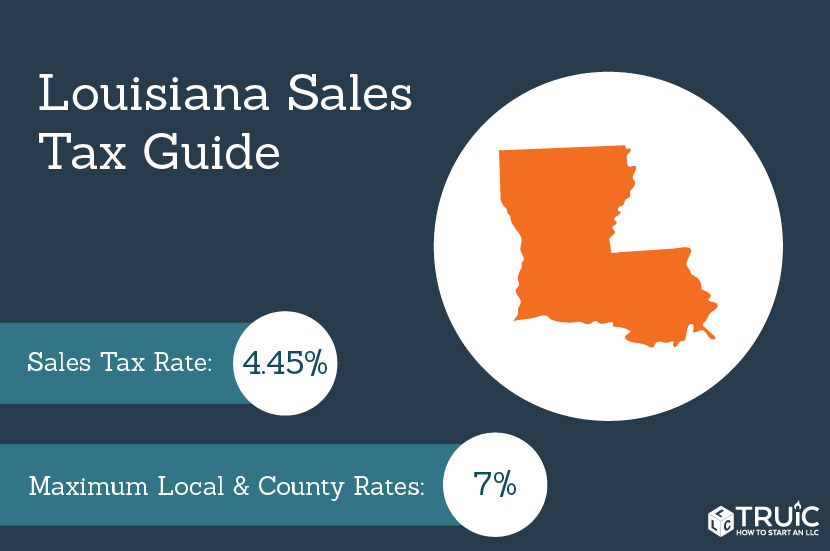

An estate or trust may make estimated. Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn. Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent.

The rate threshold is the point at which the marginal estate tax rate kicks in. 4 on taxable income between 12501 and 50000. The Louisiana income tax has three tax brackets with a maximum marginal income tax of 600 as of 2022.

The top estate tax rate is 16 percent exemption. Learn all about Louisiana real estate tax. This data is based on a 5-year study of median property tax rates.

To find detailed property tax statistics for any county in Louisiana click the countys name in the data table above. According to the Business Insider reports Louisiana belongs to the states with the lowest property tax rate. One reason Louisiana has such low property taxes is the states generous.

The tax begins when the combined transfer exceeds the. The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053.

Overall Louisiana Tax Picture. Detailed Louisiana state income tax rates and brackets are available on this page. In the case of immovable property which has been sold at tax sale the tax debtor has three years within which to redeem the property.

Declaration of Estimated Tax. The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. 2022 List of Louisiana Local Sales Tax Rates.

At just 053 Louisiana has the fifth lowest effective property tax rate of any US. Louisiana Tax Commission The Louisiana. Louisiana is fairly tax-friendly for retirees.

On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832. Louisiana collects income taxes from its residents utilizing 3 tax brackets. The median annual property tax payment in Louisiana is 919 though this can drop to around 200.

Average Sales Tax With Local. The Best Louisiana Property Tax Exemption Advice. Louisiana estate tax.

Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax. The average annual tax on. Louisiana does not levy an estate tax against its residents.

The estate tax rate is based on the value of the decedents entire taxable estate. No estate tax or inheritance tax. The Economic Growth and Tax Relief Reconciliation Act of.

The top estate tax rate is 12 percent exemption threshold. The state does not tax Social Security benefits or public pension income. Three parishes in metro New Orleans were in the Top 10 with the highest property tax rates among Louisianas 64 parishes according to the Louisiana Tax Commissions annual.

2 on the first 12500 of taxable income. Of all the states Connecticut has the highest exemption amount of 91 million. When it comes to estate tax Ive got some good news.

Louisiana has one of the lowest median property tax.

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Property Tax Calculator Smartasset

Mortgage Guidelines After Chapter 7 Bankruptcy Requires 2 Years For Fha And Va And Four Year Waiting Period To Quali Mortgage Mortgage Rates Mortgage Interest

Louisiana La Tax Rate H R Block

Historical Louisiana Tax Policy Information Ballotpedia

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Louisiana Retirement Tax Friendliness Smartasset

Killean House House Styles Architecture House

Louisiana Sales Tax Small Business Guide Truic

115 Fitzwilliam Street Louisiana Homes House Styles Tuscany Villa

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Louisiana Ranks Favorably In New Property Tax Analysis Biz New Orleans

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

It S Surreal Louisiana Tax Collections Plummet Nearly 500m As Lawmakers Balance Budget Coronavirus Theadvocate Com

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States